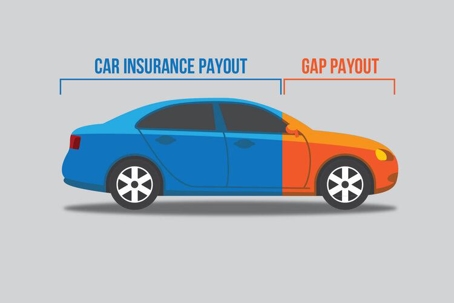

Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the car's depreciated value. Gap insurance is also called "loan/lease gap coverage." This type of coverage is only available if you're the original loan or leaseholder on a new vehicle. Gap insurance helps pay the gap between the depreciated value of your car and what you still owe on the car at the time the car is totaled or stolen.

How Does Gap Insurance Work in Texas?

Gap insurance isn't required in Texas. When you buy or lease a new car, the car depreciates in value quickly over the first few years, meaning the amount of money you owe on the vehicle is often greater than its value. In fact, your new car depreciates and is worth less the moment you drive it off the dealer’s lot. If your car is then totaled in an accident, or stolen, the amount of money you would receive from the insurer would only equal the vehicle's actual cash value at the time of the incident. Gap insurance covers the difference, or “gap,” between what you owe on the car and its actual cash value, so you won't have to make payments for a vehicle you no longer possess. Therefore, gap insurance coverage is a great thing to have if you purchase a new car but is not generally worth it if your car is several years old, or if you bought it used.

Texas Gap Insurance Laws

Gap insurance is not required in the state of Texas, and it can't be required as a condition of receiving an auto loan or lease. If you choose to purchase a gap waiver, Texas law limits the cost of coverage to 5% of the loan amount, assuming you purchased the car, per the retail installment contract. Similarly, if you leased your car, a gap waiver can only cost up to 5% of the adjusted capitalized cost specified in your lease.